1). Which of the following statements regarding interest tax shields is correct?

- Taxes are reduced by the amount of a firm’s interest-bearing debt.

- Taxable income is reduced by the amount of a firm’s interest-bearing debt.

- Taxes are reduced by the amount of the interest on a firm’s debt.

- ( Taxable income is reduced by the amount of the interest on a firm’s debt. )

2). Which of the following would NOT be considered a cost of financial distress?

- ( Lack of interest tax shields )

- Bankruptcy costs

- Excessive risk-taking by shareholders

- Loss of customers or suppliers

3). When considering the impact of distress costs on capital structure, which of the following facts should lead ABC Corporation to set a higher target debt ratio than XYZ Corporation (all else equal)?

- ( ABC’s cash flows from operations are less volatile than XYZ’s. )

- ABC is a computer software firm, and XYZ is an electric utility.

- ABC operates in a more competitive industry than XYZ.

- ABC’s assets have lower resale values than XYZ’s assets.

4). According to the pecking order theory of capital structure, why do firms avoid issuing equity?

- Because fees associated with issuing new equity are so high

- Because they want to avoid dilution of earnings per share

- Because they do not want to commit to paying dividends on the new equity

- ( Because equity issuance signals negative information about the firm )

5). Under the simplifying assumptions of Modigliani and Miller, an increase in a firm’s financial leverage will

- ( increase the variability in earnings per share. )

- reduce the operating risk of the firm.

- increase the value of the firm.

- decrease the value of the firm.

6).

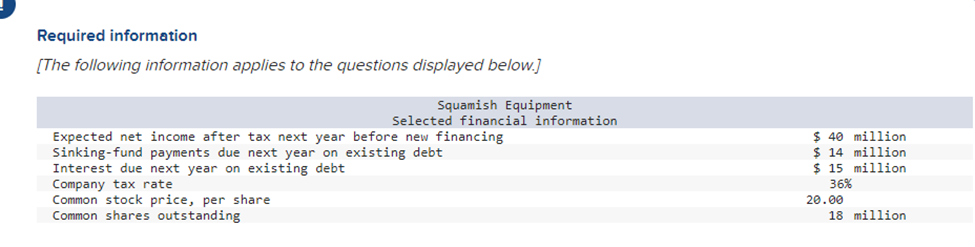

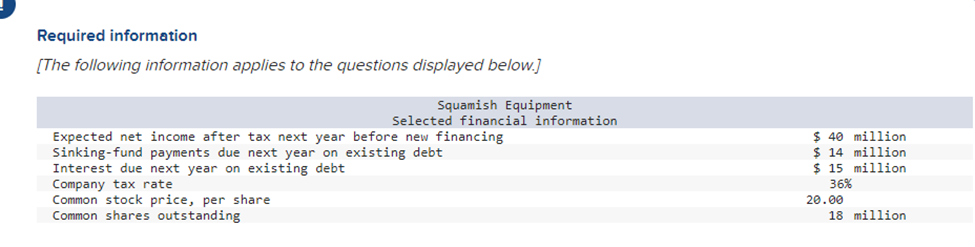

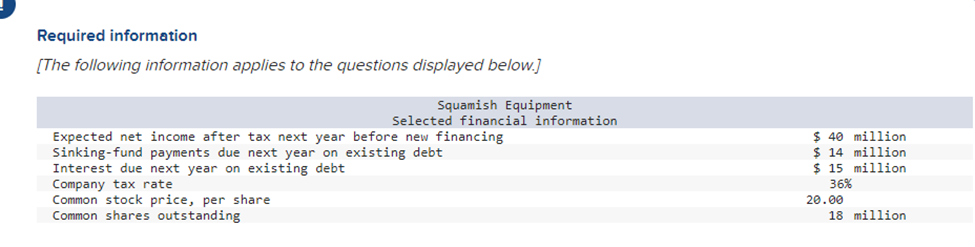

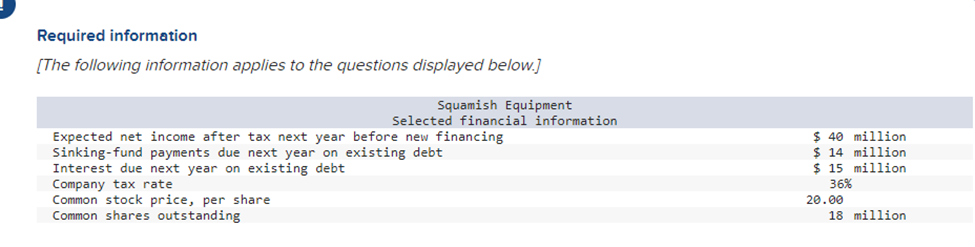

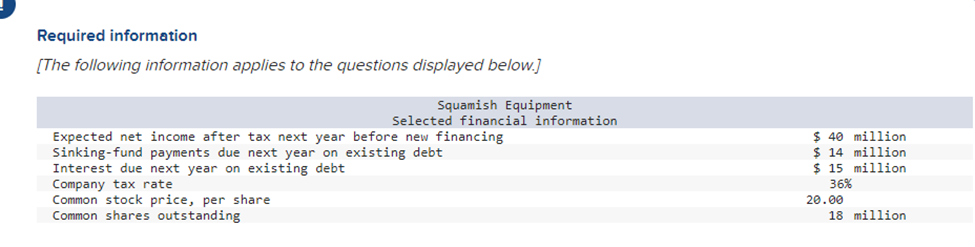

Please refer to the financial information for Squamish Equipment above. For next year, calculate Squamish’s times-burden-covered ratio if Squamish sells 2 million new shares at $20 a share.

- 1.03

- 1.38

- 1.60

- 1.89

- ( 2.10 )

- None of the options are correct.

7).

Please refer to the financial information for Squamish Equipment above. For next year, calculate Squamish’s earnings per share if Squamish sells 2 million new shares at $20 a share.

- 1.28

- 1.39

- ( 2.00 )

- 2.22

- 4.00

- None of the options are correct.

8).

Please refer to the financial information for Squamish Equipment above. Calculate Squamish’s times-interest-earned ratio for next year assuming the firm issues $40 million of new debt at an interest rate of 7%.

Top of Form

- 2.00

- 3.09

- 3.66

- ( 4.35 )

- None of the options are correct.

9).

Please refer to the financial information for Squamish Equipment above. Calculate Squamish’s times-burden-covered ratio for the next year assuming the firm issues $40 million of new debt at an interest rate of 7%, and that annual sinking fund payments on the new debt will equal $8 million.

Top of Form

- 1.01

- 1.08

- 1.38

- ( 1.49 )

- 1.95

- None of the options are correct.

10).

Please refer to the financial information for Squamish Equipment above. Calculate Squamish’s earnings per share next year assuming Squamish issues $40 million of new debt at an interest rate of 7%.

Top of Form

- 1.28

- 2.00

- ( 2.12 )

- 2.22

- 3.06

- None of the options are correct.

Other Links:

Statistics Quiz

Networking Quiz

See other websites for quiz:

Check on QUIZLET

Check on CHEGG